ROI – Return on Investment Istanbul Properties

Istanbul, one of the most historically rich and culturally vibrant cities in the world, has also become a highly attractive destination for property investors in recent years. With its dynamic real estate market, strategic location, and growing economy, Istanbul presents an appealing prospect for both domestic and international investors. But when it comes to investing in Istanbul properties, one of the most important factors to consider is the Return on Investment (ROI).

This blog post will explore the key aspects of ROI in Istanbul properties, helping potential investors understand how to maximize their returns and make informed decisions in this competitive market.

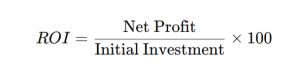

Return on Investment (ROI) is a measure used to evaluate the profitability of an investment, expressed as a percentage. In real estate, ROI is calculated by dividing the net profit from an investment by the initial cost, then multiplying by 100. For Istanbul properties, this involves considering factors like rental income, capital appreciation, and associated costs (e.g., property taxes, maintenance, and management fees).

Before diving into the specifics of ROI, let’s first understand why Istanbul is such an appealing real estate market:

Strategic Location: Istanbul’s unique location, bridging Europe and Asia, makes it a prime city for business, tourism, and investment. The city is a key financial and commercial hub in the region, attracting international businesses, multinational companies, and investors. This global connectivity contributes to its property market growth.

Growing Economy: Istanbul is the economic heart of Turkey, contributing a significant portion to the national GDP. Its economy is diversified, with sectors like manufacturing, technology, finance, tourism, and retail driving growth. As the city’s economy grows, so does the demand for both residential and commercial properties, boosting the real estate market.

Population Growth: Istanbul’s population continues to grow at a rapid pace, with more people moving to the city for work, education, and better living conditions. This population growth fuels demand for housing, commercial spaces, and services, creating opportunities for investors in both the residential and commercial property markets.

Tourism and Short-Term Rentals: As one of the top tourist destinations in the world, Istanbul’s tourism sector offers unique opportunities for property investors. Many investors opt to purchase properties for short-term rentals, capitalizing on the influx of tourists who visit the city throughout the year. Platforms like Airbnb have made this a popular avenue for generating rental income.

Government Incentives: The Turkish government has introduced various incentives for foreign investors, such as citizenship by investment and tax benefits. These policies have made Istanbul even more appealing to international buyers looking to invest in the city’s real estate market.

To better understand ROI in Istanbul properties, we need to consider the key factors that influence the potential for return. Let’s break them down:

Location is one of the most significant factors determining ROI in Istanbul properties. Neighborhoods in central areas like Beyoğlu, Beşiktaş, Şişli, and Kadıköy typically offer higher rental yields and better capital appreciation over time. Properties located near transportation hubs, business districts, and popular tourist attractions tend to be more in demand, ensuring steady rental income and long-term value growth.

On the other hand, properties in emerging neighborhoods or those undergoing urban renewal may offer higher potential for capital appreciation as the area develops. However, these areas may have lower rental yields initially, meaning a longer time to see returns.

The type of property you invest in plays a crucial role in determining ROI. Residential properties, such as apartments or houses, may offer stable rental yields, particularly in high-demand areas. On the other hand, commercial properties, like office spaces or retail stores, may generate higher rental income, but they come with more volatility and risk, especially in a fluctuating economy.

Short-term rental properties, which are increasingly popular in Istanbul, can also offer higher rental yields due to the constant influx of tourists. However, managing short-term rentals can require more effort and resources, as they involve dealing with frequent turnover of tenants and ongoing maintenance.

Rental yields in Istanbul can vary significantly based on location, type of property, and market conditions. On average, residential properties in central areas can offer 5-7% annual rental yield, while properties in peripheral areas might generate 8-10%. However, short-term rental properties in prime locations can provide even higher yields, with some investors reporting returns as high as 15-20% annually.

Investors should consider the long-term sustainability of rental yields, as short-term rental income can fluctuate depending on seasonality and tourism trends.

Capital appreciation is the increase in the property’s value over time. Istanbul has seen significant property price growth over the past decade, with certain areas experiencing substantial appreciation. However, capital growth rates can vary depending on factors like infrastructure projects, government development plans, and demand in specific neighborhoods.

Investors who purchase properties in areas with planned improvements, such as new metro lines or urban regeneration projects, may see greater capital appreciation over time. For example, the ongoing developments in Büyükçekmece, Üsküdar, and Kartal have been driving property values upward, making them attractive areas for investment.

Maintenance costs and additional expenses can impact the overall ROI of a property. Property owners in Istanbul must consider costs like annual property taxes, utilities, insurance, and repair and maintenance. These costs can be higher in older buildings or luxury properties, so investors need to factor these expenses into their ROI calculations.

Additionally, some properties may require renovations or upgrades to achieve maximum rental income, which can increase initial investment costs but lead to higher returns in the long run.

As with any real estate market, timing is crucial when investing in Istanbul properties. The city’s real estate market can fluctuate based on economic cycles, political events, and global market conditions. Investors who can identify market trends and buy during a downturn or market correction can often realize higher returns as property prices rebound.

It’s important to stay informed about the broader market conditions and consult with local experts who can provide insights into the timing of property investments.

To maximize ROI in Istanbul properties, investors should adopt several strategies:

Choose the Right Neighborhood: Researching neighborhoods and identifying emerging areas with growth potential can significantly impact your returns. Consider areas with strong infrastructure projects, increasing demand, or proximity to business and tourist hubs.

Diversify Your Investment Portfolio: Diversifying between residential, commercial, and short-term rental properties can help balance risk and reward. Short-term rentals can provide higher yields, while residential and commercial properties offer more stability.

Consider Property Management Services: If you’re not based in Istanbul or prefer to focus on other aspects of your investment strategy, using a reliable property management service can help you efficiently manage your property and ensure maximum rental income.

Monitor Market Trends: Keeping track of market trends, interest rates, and economic conditions can help you time your investment and sales better. Look for signs of a booming market and act before prices peak.

Leverage Government Incentives: Take advantage of government incentives for foreign investors, such as tax benefits, which can improve your overall ROI.

Kocaeli villa for sale

Luxury 5 Star Hotel For Sale in istanbul

Investing in Istanbul properties can be a highly profitable venture, but like any investment, it requires careful planning, research, and understanding of the market dynamics. By considering factors such as location, property type, rental yields, capital appreciation, and maintenance costs, investors can make informed decisions that maximize their ROI.

With its growing economy, strategic location, and diverse property options, Istanbul remains one of the top real estate investment destinations. However, understanding the local market trends and working with reliable professionals is key to making the most of your investment in this vibrant city.